ayurvedic hair oil gst rate

100ml Natural Herbal Hair Oil. Sandhilin oil is an Ayurvedic proprietary medicinal oil that helps relieve pain.

Gst Rate In India A Complete List Of Essential Commodities

The above result is only for your reference.

. Manjushree Hair Oil - SDM. Hubcoin shall not be responsible for any damages or problem that may arise to you on relying on the above search results. 1 offer Next page.

Export and Import HSN Codes. Is GST applicable on exports in India. 15021010 15021090 15029010 15029020 15029090.

HSN Code Product Description. Gst Rates Here S Your Complete Guide Discountwalas. Here you can search HS Code of all products we have curated list of available HS code with GST website.

Hair oil 15-11-2017 to 24-01-2018. Gst rate applicable to ayurvedic medicines is put at 12 as against 5 for allopathic medicine. Sign up for free.

Home 18 GST Manjushree Hair Oil - SDM. HSN Code3304 3305 3306 -Skin care herbal products. Know what else have been changed.

Preparations for use on the hair. Ad Buy the best effective Ayurvedic Products at the best prices. Yes GST is applicable on exports in India and is 5 12 18 and 28 depending upon HS Code of Herbal Hair Oil.

33059030 - Hair oil. Find GST HSN Codes with Tax Rates. Check out Adivasi Ayurvedic Hair Oil 950ml reviews ratings specifications and more at Amazonin.

Hair oil toothpaste and soaps will be taxed at 18 percent under GST significantly lower than the present effective rate of 28 percent. Organic surface-active products and preparations for use as soap in the form of bars cakes moulded pieces or shapes. This hsn code showing 12 Tax rate.

Yes GST is applicable on exports in India and is 5 12 18 and 28 depending upon HS Code of Herbal Hair Oil. The procedure to find HS Code with tax rate is very simple. There are other ayurvedic products like soaps shampoos gomutra tulasi arc etc.

Hair cream Search List of Indian ITC HS Code and HS classification System Code Harmonised System product code Exim Codes Lookup and HS Code Finder. Know what else have been changed. GST rate for classical or generic range of ayurvedic medicines must be nil and 5 per cent for patented products instead of the proposed 12 per cent the Association of.

In above box you need to type discription of productservice or HS Code and a list of all products with codes and tax rates will be displayed. The export duty for Herbal Hair Oil is paid by the exporter of the Herbal Hair Oil. This is quite strange and unreasonable discouraging use of the effective age old ayurvedic system.

Classification of goods - rate of GST - Himsa Plus Oil which is a ayurvedic hair oil used for various hair disease and headache - beauty product or medicinal products - The product Himsa Plus Oil is poured on hair for beautification or promoting attractiveness as the same is in the nature of cosmetics. Get GST invoice and save up to 28 on business purchases. Buy Adivasi Ayurvedic Hair Oil 950ml online at low price in India on Amazonin.

Haldi Powder Moringa Oleifera Leaf Moringa Leaf Extract Herbal Tea Dietary SupplementAyurvedic Medicine Amla Powder Ginger Extract Ashwagandha Herbal Extract Cordyceps Militaris. Pig fats including lard and poultry fat other than that of heading 0209 or 1503. Shipping rates delivery estimates On checkout customers can view the shipping charges for the order to be placed.

Medicamentsexcluding goods ofheading 3002 3005 or 3006 consisting of mixed or unmixed products for therapeutic or prophylactic uses put up in measured doses including those in the form of transdermal administration systems or in forms or packings for. The export duty for Herbal Hair Oil is paid by the exporter of the Herbal Hair Oil. The rate of tax of products covered under the head of Medicaments is 12 the same product when seen with the eyes of cosmetics corresponds to 18 and even 28 in certain cases.

The above result is only for your reference. All HS Codes or HSN Codes for herbal products with GST Rates. Wholesalers of an immersed collection of Herbal Hair Oil Massage Oil Pain Relief Oil Ayurvedic Face Powder.

Which Emami positions as an Ayurvedic hair oil has a 34 per cent share of the Rs 720 crore segment. Other Sites from dabur family. Preparations for use on the hair HSN Code 3401.

GST Rates HSN Codes for Cosmetics Essential Oils Perfumery - Essential oils terpeneless or. Account Bird 157 Points Replied 25 July 2020. Preparations for use on the hair.

Natural Hair Growth Oil. We request the government for a review of the GST rate for the ayurvedic category in. GST Rate Schedule for Goods.

VALVESINLET AND EXHAUST Products Include. Vijayprakash P 1308 Points Replied 25 July 2020. HS Code Description GST 12119029.

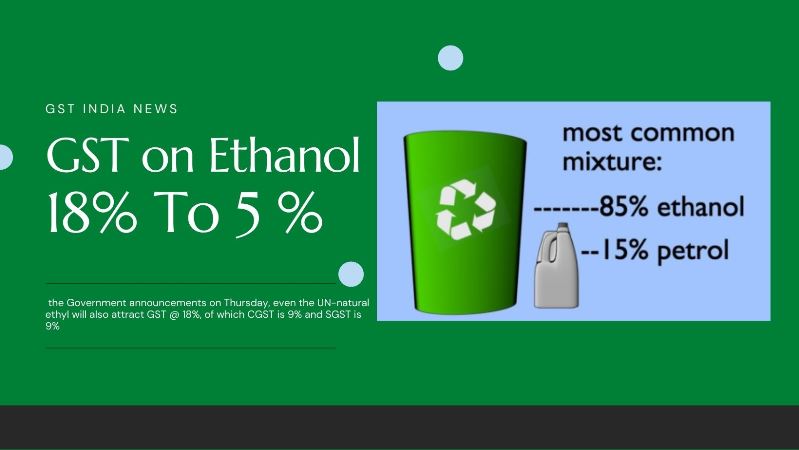

GST on Ayurvedic products revised from 12 to 5. 48 Bottle. Home Clients Testimonials Feedback Site Map.

- As such the product Himsa Plus Oil is predominantly a hair oil ie. Sankaranarayanan FREELANCER 22 Points. Patanjali Ayurveda the wellness grocer that has upended Indias well-settled consumer goods leader board is unhappy with the tax slab proposed for its products under the Goods and Services Tax plan the introduction of which would more than double the levy to 12.

Call 08047304671 92 Response Rate. Fats of bovine animals sheep or goats other than those of heading 1503. Dabur presents a range of Herbal Ayurvedic Personal Care products created to make you look and feel good.

Ms Wire Products Include. Where herbals and other natural ingredients are used. GST Classification of Ayurvedic Beauty and Make-up Preparations.

GST in the Media. Ok Thanks mistakenly I saw ayurvedic products hsn code. GST Rate Schedule for Goods.

Anmol Gold Coconut Oil. Kindly consult the professional before forming any opinion. DIGITAL DUPLICATOR Products Include.

Vinya Ayurveda Hair Oil 100ml Inc GST Category. GST Laws.

For Gst Hsn Code And Its Rate On Neha Chauhan Co Facebook

Hsn Code Gst Rate For Cosmetics Essential Oils Perfumery Chapter 33 Tax2win

Iiem Indian Institute Of Export Management Gst Rates Schedule For Goods Announced On 18 05 2017 Following List Shows Rates For Salient Items For Entire List Of Items Visit Http Iiem Com News Resources Comment Below If

Gst Rate Changes For The Year 2020 2021 Vakilsearch

Gst Rates For Goods And Services With Hsn Company Suggestion

Overall Structure Of Goods And Services Tax In A Nutshell

Gst Rates Know Gst Rates In India Tax Exempt Items Slabs More

Rate Of Gst For Perfumes Cosmetics Essential Oil Toilet Preparations

Gst On Ayurvedic Products Revised From 12 To 5 Know What Else Have Been Changed

Gst Rates In India Gst Rate Finder Item Wise Gst Rate List In Pdf

Gst Rates In India For Quotidian Goods And Services Gst Rate List

Gst Rate For Perfume Cosmetics And Toiletries Indiafilings

Patanjali Asks Government To Exempt Ayurvedic Medicines From Gst

Gst Tax Rate What Are Rate Of Taxes Under Gst Taxmann Blog

Gst Rates Here S Your Complete Guide Discountwalas

Gst Rate In India A Complete List Of Essential Commodities

M S Paul S Tax Solutions Home Facebook